1.0 INTRODUCTION

Malaysia, a country once ranked 24th in terms of world oil reserves and 13th for world gas reserves is suffering together with the world after price increases in oil and gas. Isn’t that ridiculous? According to Fong, C. 2006, ‘Cremations may cost more now’, The Star Online, 21st April, diesel prices have increased from RM0.90/L in October to the current RM1.98. Besides, there was just a recent increase in petrol prices by 30 cents, from RM1.61/L to the current RM1.91.

The article I have chosen, entitled ‘Time to conserve energy’, The Star Online, 30th March 2006, describes the increase in petroleum prices as well as energy prices. It talks about the response of consumers towards this price increase and how it affects the economy. This article mentions that the Malaysian government did the right thing by raising the prices of petroleum products, but could have improved the way the price increase was handled. It also says that the conservation and efficiency of energy, particularly petroleum, should be the new way of life for consumers. Besides, it also talks about the cause and effects of the price increase in petroleum.

2.0 ANALYSIS

2.1 Demand & Supply

In the main article, ‘Time to conserve energy’, The Star Online, 30th March 2006, it is stated that the price of petrol has to be increased worldwide because the price mechanism in a free market economy must be allowed to function efficiently. If not, our scarce/limited resources would not be allocated efficiently.

Price mechanism is a system whereby prices of goods and services and prices of the factors of production are determined through the market forces of demand and supply. In the goods market of petroleum, if demand for petrol is greater than the supply of petrol, the price of petrol will increase and vice versa. Quantity demand is defined as the amount of the good that buyers are willing and able to purchase.

A movement along the demand curve is caused by changes in the price of the good itself ceteris paribus, all other factors remaining constant. The recent 30 cent increase in petrol will result in an increase in price from the previous RM1.61, to the current RM1.91/L. Thus, causing an upward movement (contraction) along the demand curve – quantity demanded would decrease.

This is in accordance with the Law of Demand that states that other things being equal, the quantity demanded of a good falls when the price of the good rises.

A shift in the demand curve, or change in demand is caused by other factors and not by price. For example, a change in income, changes in tastes and preferences, increase in population etc. One of the factors is the change in the price of other goods, e.g. substitute/ complementary goods. In this article, we can use the example of cars as a complementary good for petrol. Complements can be defined as goods that are demanded together to fulfill one’s satisfaction.

According to Nathan, D.M. 2006, ‘National Automotive Police arrives’, The Star Online, 25th March, the National Automotive Policy had unveiled a reduction in car prices. Even though the quantity demand for petrol is said to decrease due to the increase in the price of petrol, we can also imply that the demand for petrol may not decrease as much as it is supposed to because there is also a decrease in the price of cars after the implementation of the National Automotive Policy (NAP). Consumers are more prone to buying cars after the reduction in prices, and thus, there may be a slight increase in the demand for petrol because cars and petrol are complements. We can also link this concept to joint demand, when there is an increase in the demand for good X, which in this case we can say is cars, the demand for good Y, petrol, will also increase.

Subsidies can be defined as grants or payments by the government to the producer to reduce the costs of production in order to encourage production and consumption of a good. When the government withdrew their subsidies for petrol by 30cents/L, the price increased from RM1.61 to RM1.91 per litre. Thus, in accordance with the Law of Demand, also resulting in a decrease in demand for petrol.

2.2 Elasticity

Price Elasticity of Demand

Price elasticity of demand is defined as the degree of the responsiveness of quantity demanded to changes in price, ceteris paribus. In the short-term, we can imply that petrol has elastic demand, that is people are responding to the increase in price of petrol - there may be a slight decrease in the demand for petrol following the increase in price. Consumers may try to consume less following the increase in petrol prices. For example, opt for carpooling, public transport, or even walking instead of driving.

However, in the long-term, petrol is said to have inelastic demand as people slowly adjust to the increase in price. They know that the price of petrol will remain at the higher price and thus, have no choice but to attend to it. In addition, petrol currently has no close substitutes, so even though price increases, those who have cars do not have a choice but to purchase petrol at the higher price.

On the other hand, if, for example, in the future, substitutes for petrol are found, just like how bio-fuel was found as a substitute for diesel, demand will change back to elastic because there is the availability of competition, thus, consumers have choices.

In this case, the government may be using this concept/ significance of elasticity of demand to increase their revenue. In our current situation, the government has withdrawn portions of their subsidies for petrol. They know that the demand for petrol is inelastic. According to the article, ‘March inflation at 4.8%’, The Star Online, 20th April 2006, the price of petrol has increased by 23%. Now, for example if the quantity demanded for petrol decreased by 10%, government revenue would have increased by 13% (23%-10%).

Cross Elasticity of Demand

Cross elasticity of demand is defined as the degree of responsiveness of one good to a change in the price of another good. In this case, the increase in the price of petrol may decrease the quantity demanded for cars even though the price of cars has reduced after NAP. There is a negative relationship between the price of petrol and the quantity demand for cars (complementary goods), thus, is a negative cross elasticity.

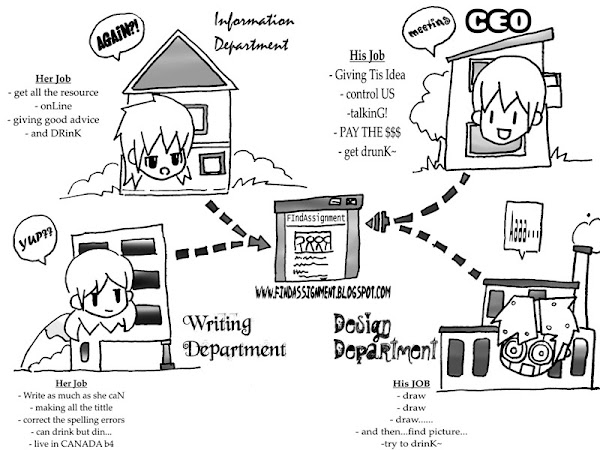

Some words of Welcome from the FindAssignment Team...

Hi y'all...

We're juz a bunch of friends who have created a blogspot where "SHARING" is the key. We just wanna "share" some information and guides to assessments to reduce your burden, and we hope you can do the same for us!

Please "share" your information with us through findassignment@gmail.com , or contact us if you have any enquiries.

Happy "Sharing"!

FindAssignment Team

We're juz a bunch of friends who have created a blogspot where "SHARING" is the key. We just wanna "share" some information and guides to assessments to reduce your burden, and we hope you can do the same for us!

Please "share" your information with us through findassignment@gmail.com , or contact us if you have any enquiries.

Happy "Sharing"!

FindAssignment Team

The Gold Mine

-

▼

2008

(26)

-

▼

May

(25)

- IJM Plantations Berhad

- Cheetah Corporation (M) Sdn Bhd

- What is corporate reputation? Is reputation a sui...

- Carlsberg Brewery Malaysia Berhad

- Astro All Asia Network plc

- KFC Marketing Plan

- Crisis management plan for Transmile

- Special meeting on diesel quotas as crisis worsens

- Time to Conserve Energy

- Marketing Research

- The Proposal of International Operation in Argentina

- Sales Management

- Krispy Kreme

- Should liquor be banned in Malaysia

- International Management Report: foreign language

- Investment Portfolio

- PETRONAS

- Marketing Research : Malaysia TM company

- Women’s Aid Organisation (WAO) Public Relations Plan

- TMnet

- Corporate Social Responsibility: A Worthwhile or S...

- Developing A Public Relations Plan for the Sarawak...

- The spin cycle … and when it all goes wrong

- JP Morgan Chase and Bank One Merger Deal Terms

- Case Study: Ministry of Sound

-

▼

May

(25)

Count Started: May 13, 2008

FindAssignment Team

Our TeaM InfO

Categories

- Business (2)

- Corporate Social Responsibility (1)

- Economics (2)

- Finance (2)

- International Management (1)

- Management (1)

- Marketing (3)

- Marketing Research (1)

- Public Relations (5)

- Research Essay (1)

- Sales Management (1)

- Strategic Marketing (4)